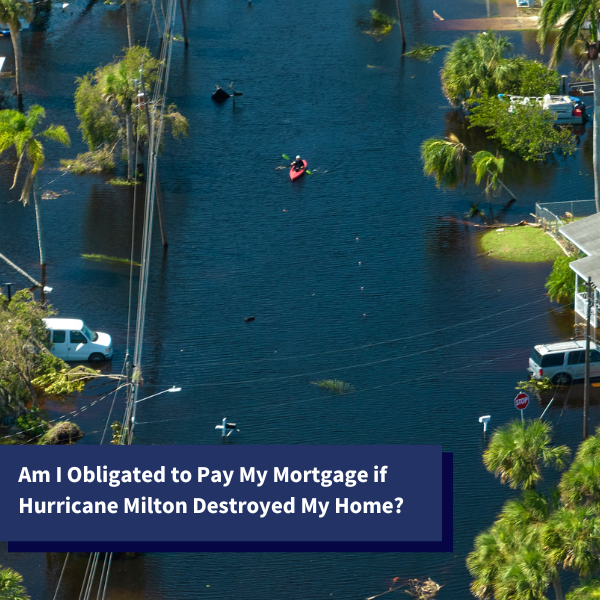

Hurricane Milton is predicted to bring more damage and devastation to Florida than the state has seen in a century. For those in the path of the storm, and flooding zones, losing your home completely is a very real and valid concern. Losing your home is devastating. Not only do you have to make many important decisions, such as if you will rebuild, but the disaster also places you in a financially difficult situation.

Paying your mortgage may not be at the top of your mind at this time. So, are you still obligated to pay your mortgage if Hurricane Milton completely destroyed your home? The short answer is yes, you are. However, there may be options that can help you cover your mortgage payments.

Why Pay Mortgage Payments if Hurricane Milton Destroyed Your Home

The sad truth is that with the destruction Milton is expected to bring, many people are in fear of losing their homes. Unfortunately, even though your home is destroyed, you are still responsible for making the mortgage payments. If you suddenly stop making mortgage payments, it can result in serious consequences.

Your lender may still foreclose, even though there is no physical standing structure. Even if your lender does not decide to pursue foreclosure, missing mortgage payments will still result in late fees, additional interest, and a negative impact on your credit score. Unfortunately, a destroyed home due to a hurricane does not absolve you of your mortgage payments.

Qualifying for a Mortgage Forbearance

Again, while you are still expected to pay your mortgage after disaster strikes, there are options available that may help. If you cannot pay your mortgage, you can ask your lender for a forbearance. If your lender agrees, you will not have to pay your mortgage for a certain amount of time, which is usually between six months and one year. This option is ideal for homeowners who experience short-term financial hardship and who can afford to make payments in the near future. This relief period can also provide you with additional funds to look for a new place to live or to make repairs to your home.

It is important to remember that once the forbearance period expires, your lender may expect you to make larger mortgage payments to make up for those that were delayed. As such, it is critical that you understand if you can afford to make these larger payments in the future. While forbearance will not force you to incur late penalties, you may still have to pay interest on those payments, which may be significant, depending on how long the forbearance period was.

Homeowner’s Insurance May Help if Milton Destroys Your Home

If you have a mortgage, you likely also have homeowner’s insurance. While state law in Florida does not require homeowners to purchase this type of insurance, the vast majority of lenders do. As such, if you currently have mortgage payments, you probably also have insurance that can help after Milton and other disasters. If your home is completely destroyed, your insurance policy should provide coverage up to the value of the property stated in your policy, as well as coverage for the contents of your home. This can cover all of your mortgage payments.

There are times when your homeowner’s insurance policy may not fully cover the cost of your mortgage payments. For example, if you were underinsured, the coverage may not be enough to fully pay off the mortgage that remains on your home. Sadly, some homeowners have enough coverage to fully cover the cost of their mortgage payments but the insurer refuses to pay it. In these instances, your insurance company may be acting in bad faith. If so, you may have to take legal action against them to obtain the coverage you are entitled to.

How to Know if Insurer is Acting in Bad Faith After Milton

Communities in Florida often band together and try to help each other after a hurricane or other natural disaster. Unfortunately, the same is not always true for insurance companies. If you suspect that you are not being treated fairly, it is important to speak to a Florida foreclosure defense attorney who can advise you of your rights. Some homeowners, though, are not aware that the insurer is treating them unfairly. Some of the most common examples of bad faith insurance tactics are as follows:

- Unreasonable denials: Your insurance company may deny your legitimate claim by saying the type of damage was not covered in your policy. For example, they may claim that the damage is actually from flooding and not wind as you stated. In this case, they may deny your claim even though the damage was from wind and your policy covers this.

- Delayed coverage: If Milton has completely destroyed your home, you need help as quickly as possible. Your insurance company has a duty to communicate with you, respond to your claim, and provide coverage all within certain timeframes. If they fail to do so, they may be violating your rights.

- Underpaying claims: Your insurance company may not provide you with the full coverage you are entitled to based on your policy. Sadly, this happens more often than people think after a property has been destroyed because the insurer may undervalue the cost of rebuilding the property.

- Unreasonable cancellations: Another strategy that is all too common among insurers is unreasonably canceling your policy. The insurance companies will handle hundreds of calls from homeowners who have lost everything after Milton. To preserve as much of their profits as possible, they may cancel some of these policies after claiming the terms were violated, such as that the policy was not renewed. Insurers sometimes make these claims even when they are not true.

Our Foreclosure Defense Attorneys in Fort Lauderdale are Here to Help

Whether you need to negotiate a forbearance or you suspect that your insurance company is not being honest, you need legal help. At Loan Lawyers, our Fort Lauderdale foreclosure defense attorneys can provide the assistance you need during this time. We can communicate with your bank, servicer, or insurance company on your behalf and ensure that your rights are respected. Call us now at (954) 523-4357 or contact us online to schedule a free consultation.

- About the Author

- Latest Posts

Matis Abarbanel is the founding partner and senior attorney at Loan Lawyers in South Florida. He focuses his practice on consumer rights, helping homeowners navigate issues such as foreclosure and financial hardship. Matis also brings a wealth of experience from his previous work in personal injury law. As a devout Chasidic Jew, he is committed to making a positive impact in his community and dedicates his efforts to charitable initiatives through his non-profit organization, The Center, which aids at-risk Jewish youth. Matis actively serves clients across South Florida and is passionate about empowering individuals to secure their rights and achieve a better future.